Nigeria’s Women Entrepreneurs Hold the Key to Economic Growth—Are Banks Ready to Invest?

Nigeria’s women-led businesses make up 40% of SMEs, yet they remain financially underserved.

In Nigeria, women own 40% of small and medium-sized enterprises (SMEs), yet they receive only a fraction of total bank credit. This imbalance isn’t just unfair—it’s holding back the country’s economy. But things are starting to shift.

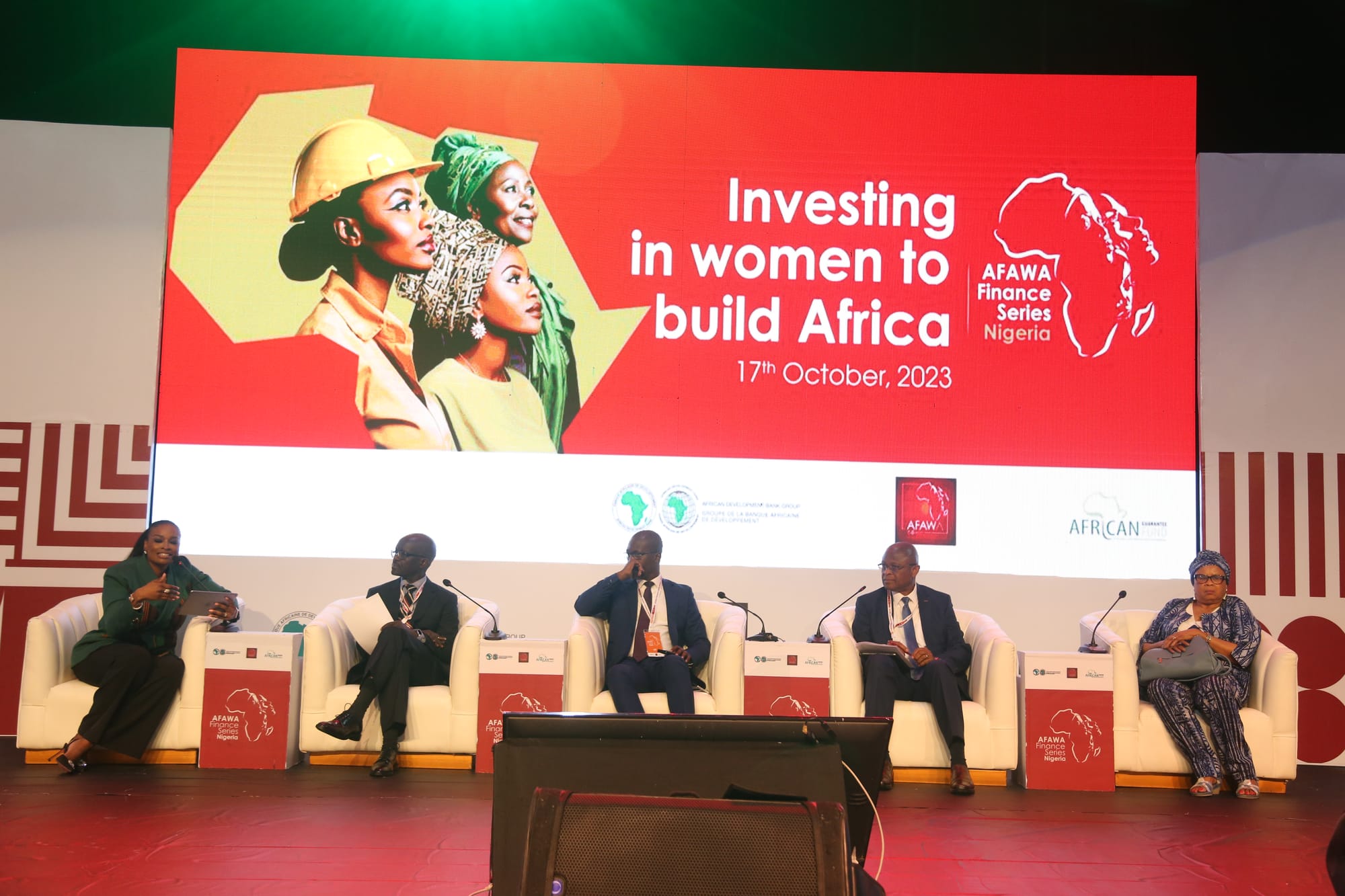

The AFAWA Finance Series was hosted in Lagos, bringing together government leaders, financial institutions, and development partners to explore how gender-inclusive finance can unlock billions in economic potential.

Nigeria’s Banking Sector: The Next Frontier for Gender-Smart Financing

At the heart of the discussions was AFAWA’s Guarantee for Growth (G4G) program, a risk-sharing facility designed to help banks de-risk lending to women entrepreneurs. With micro, small, and medium-sized enterprises (MSMEs) making up over 75% of Nigeria’s workforce, the potential for impact is massive.

“There is a real opportunity for scale,” said Dr. Beth Dunford, AfDB Vice President for Agriculture, Human, and Social Development. With the right financial products and policies, women-led businesses can accelerate Nigeria’s economic transformation.

Beyond Talk: A Call for Action

Nigeria is already taking steps in the right direction, with policymakers exploring regulatory reforms to improve financial access for women. Jules Ngankam, Group CEO of AGF, stressed the urgency:

“Seventy percent of African women are financially excluded. This isn’t just about access to credit—it’s about economic power, leadership, and wealth creation.”

The event also provided training for financial institutions, helping them rethink their products and services through a gender-smart lens. The goal? Not just to lend to women entrepreneurs but to reshape the financial sector to serve them better.

A Future Where Women Entrepreneurs Lead

Through AFAWA, AfDB, and AGF, Nigeria’s financial ecosystem is shifting—but the work isn’t done yet. Women entrepreneurs aren’t asking for handouts; they’re building businesses, creating jobs, and driving innovation. The question is: Will banks rise to the occasion?